Indicators on Mileagewise - Reconstructing Mileage Logs You Need To Know

Wiki Article

An Unbiased View of Mileagewise - Reconstructing Mileage Logs

Table of ContentsMileagewise - Reconstructing Mileage Logs Things To Know Before You BuySome Known Details About Mileagewise - Reconstructing Mileage Logs The Mileagewise - Reconstructing Mileage Logs PDFsMileagewise - Reconstructing Mileage Logs Can Be Fun For EveryoneFascination About Mileagewise - Reconstructing Mileage LogsNot known Details About Mileagewise - Reconstructing Mileage Logs Rumored Buzz on Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Distance feature suggests the quickest driving route to your employees' destination. This function improves productivity and adds to set you back financial savings, making it an essential property for services with a mobile workforce.Such a technique to reporting and compliance simplifies the usually intricate job of handling mileage expenditures. There are lots of benefits associated with making use of Timeero to keep track of mileage.

10 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

These additional verification measures will certainly keep the IRS from having a reason to object your gas mileage documents. With exact gas mileage monitoring innovation, your staff members don't have to make harsh gas mileage estimates or also worry concerning gas mileage cost tracking.

For instance, if a worker drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all vehicle expenditures. You will need to proceed tracking mileage for job even if you're using the real expenditure method. Maintaining gas mileage documents is the only means to different service and individual miles and supply the proof to the internal revenue service

A lot of gas mileage trackers let you log your journeys manually while calculating the distance and reimbursement amounts for you. Many additionally featured real-time journey tracking - you need to begin the application at the begin of your journey and stop it when you reach your last location. These apps log your start and end addresses, and time stamps, together with the total range and repayment quantity.

3 Easy Facts About Mileagewise - Reconstructing Mileage Logs Explained

Among the questions that The IRS states that lorry expenses can be thought about as an "common and essential" cost in the program of doing company. This includes prices such as gas, maintenance, insurance, and the lorry's depreciation. For these prices to visit this site be considered insurance deductible, the automobile needs to be made use of for business purposes.

Rumored Buzz on Mileagewise - Reconstructing Mileage Logs

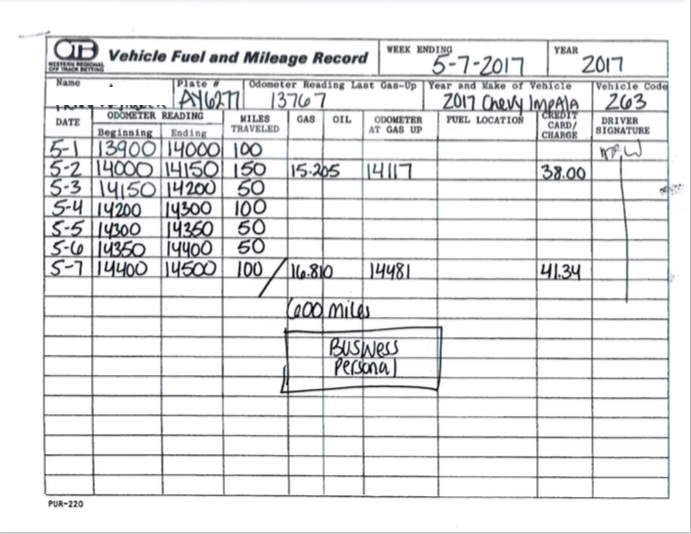

In between, carefully track all your business trips noting down the beginning and finishing readings. For each trip, document the area and business function.This consists of the complete service mileage and overall mileage buildup for the year (business + individual), journey's day, location, and purpose. It's vital to record activities quickly and keep a coexisting driving log describing day, miles driven, and business purpose. Right here's exactly how you can boost record-keeping for audit objectives: Start with ensuring a precise mileage log for all business-related travel.

The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

The real expenses technique is an alternate to the conventional mileage price method. Rather than computing your reduction based upon a fixed price per mile, the actual expenses method permits you to subtract the real expenses related to utilizing your vehicle for company purposes - free mileage tracker. These prices consist of gas, maintenance, fixings, insurance coverage, devaluation, and various other related costsThose with considerable vehicle-related expenditures or unique conditions might profit from the actual expenses approach. Inevitably, your picked method must align with your particular monetary objectives and tax scenario.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

(https://pxhere.com/en/photographer/4440280)Whenever you utilize your auto for company trips, videotape the miles took a trip. At the end of the year, again write the odometer reading. Determine your overall business miles by utilizing your beginning and end odometer analyses, and your recorded service miles. Properly tracking your precise mileage for organization journeys aids in validating your tax obligation deduction, particularly if you decide for the Standard Mileage method.

Keeping track of your gas mileage by hand can require diligence, however keep in mind, it can conserve you money on your tax obligations. Comply with these actions: Jot down the date of each drive. Tape-record the complete mileage driven. Take into consideration noting your odometer readings before and after each trip. Write down the starting and ending factors for your trip.

More About Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline company sector ended up being the first commercial customers of GPS. By the 2000s, the shipping industry had actually adopted general practitioners to track bundles. And now virtually every person utilizes GPS to navigate. That means virtually everybody can be tracked as they go about their business. And there's snag.Report this wiki page